Book & Author

Ahmed Khan: Cross Border Transactions and Tax Treaties — Theory and Practice

By Dr Ahmed S. Khan

Chicago, IL

What separates developing countries from developed countries is as much a gap in knowledge as a gap in resources.

— Joseph Stiglitz

Developing countries, especially the least developed ones, often lack the necessary expertise and experience to efficiently interpret and administer tax treaties.

— UN Handbook on Selected Issues in Administration of Double Tax Treaties for Developing Countries

In today’s globalization era, the transfer of capital, goods and technology across international borders gives rise to several types of tax claims in various tax jurisdictions. Countries try to resolve these issues through unilateral as well as tax treaty arrangements.

The global community has strived to formulate an optimal framework to resolve tax disputes and to create an investment environment in which business entities are protected against the adverse effects of double taxation and the national tax authorities are assured of the collection of due revenues.

Tax treaties play a pivotal role in promoting international cooperation for effective tax practices by eliminating double taxation and tax evasion. For developing countries, the knowledge and skills gaps in the interpretation and administration of tax treaties can attenuate their capacity to be effective treaty partners.

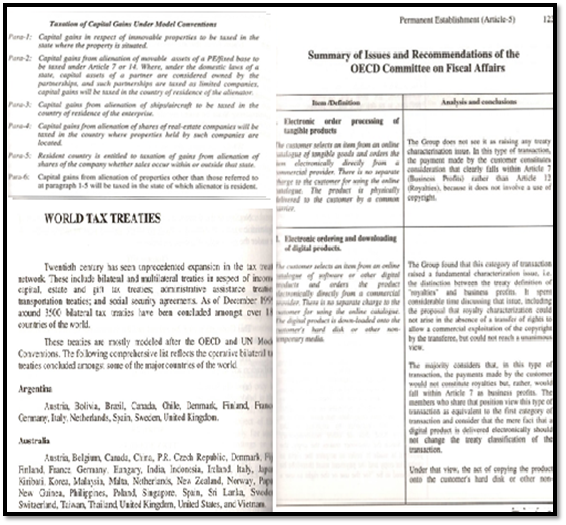

Cross Border Transactions and Tax Treaties — Theory and Practice by Ahmed Khan is a comprehensive book that addresses various contemporary tax protocols and treaties and attempts to fill a Tax knowledge gap that exists in most developing countries. The author has covered a wide spectrum of tax issues, conflicts and treaties — spanned over twenty-five chapters: Double Taxation and the Role of Tax Conventions, History of Conventions, Interpretation of Conventions, Objectives of Tax Conventions, Personal Scope of Tax Conventions, Concept of Residence, Permanent Establishment, Recommendations of OECD on Fiscal Affairs, Taxation of Business Profits, Taxation of Income from International Traffic, Taxation of Dividends, Taxation of Interest, Taxation of Royalties, Taxation of Capital Gains, Taxation of Remuneration for Personal Services , Elimination of Double Taxation, Exchange of Information, Mutual Agreement Procedure, Transfer Pricing, and International Tax Evasion and Avoidance. The book also has two annexes: UN Model Convention and World Tax Treaties.

The author, Ahmad Khan, was a career civil servant of Pakistan Tax Administration. He has been actively engaged in tax policy and administration during his over three decades of career. Specialized in the area of international taxation, he has participated in the negotiation and implementation of tax treaties for the avoidance of double taxation of income and capital in Pakistan from his early days of service.

He received his training in International Tax protocols at the Harvard Law School, Cambridge, MA, USA and was associated with the work of the UN Ad Hoc Group of Experts on Tax Treaties Between Developed and Developing Countries in his capacity as the staff to Pakistan's representative to the Group. Mr Khan has extensively contributed to the work on international taxation in the form of articles and reports. In his capacity as the Executive Director of the Asian-Pacific Tax & Investment Research Centre Singapore during early eighties, he has dealt with the investment related taxation laws in the Asian-Pacific Countries and edited the Centre's monthly Bulletin and fortnightly News Service during his assignment with the Centre. He has also compiled several of tge Centre's publications including Taxation in ASEAN Countries - A Comprehensive Guide and Analysis, Tax Planning Tax Avoidance And Tax Evasion, Some Current Issues In Taxation And Investment In the Philippines And Malaysia, Taxation In the Asian-Pacific Region - A Country by Country Survey, and Indonesian Taxation Laws.

Ahmed Khan has served as a resource person in several conferences, seminars and workshops on international taxation in several countries; more recently, the workshops organized by the German Foundation for International Development (DSE) in Singapore, Cape Town, Colombo and Amman. He has also served on various commissions and committees on reforms of tax policy and administration. During his professional career he held important positions in the Government and the statutory corporations including Member Tax Policy and Admin. in the Central Board of Revenue, and Member Monopoly Control Authority in Pakistan. The author is presently Member/Secretary of the Task Force on Reform of Tax Administration in Pakistan. He also serves as an adjunct professor for various universities in Pakistan.

In the foreword, Dr Michael Krause of the Federal Ministry of Finance (Bundesministerium der Finanzen), Federal Republic of Germany, commenting on the issues of globalization and its implications for tax protocols for nations, observes: “The globalization phenomenon has implicit in it an accelerated movement of goods, services, factors of production and technology across national boundaries. The integration of national economies into a global economy has a long history. The speed as well as the direction of the globalization trend has varied over time. A hallmark of the last quarter of the twentieth century is a marked intensification of the process of globalization. The rapid speed of the use of information and communication technology has been a major factor behind the accelerating pace of globalization. The economic manifestation of it has been a growing economic interdependence of countries worldwide. This has resulted in increases in the international labor flows; large international flow of foreign direct investment and increasing volume and variety of cross-border transactions in goods and services, international capital flows, labor migration and widespread diffusion of technology. The growing value of cross-border transactions has implications for national as well as international policies in terms of resource allocation and regulations. In this context, unless national and international tax policies with respect to cross-border transactions are amply coordinated, the probability of double taxation of these transactions is high.”

Expounding on the author's comprehensive coverage of tax issues, Dr Krause notes: “Mr Ahmad Khan addresses the policy area of double taxation in this timely book. He critically examines the role and methods of unilateral tax concessions on foreign investment to alleviate the burden arising from double taxation. The limited and often cost-ineffective nature of the unilateral tax concessions leads him to a discussion of the role of bilateral treaties and of international conventions to solve the problem of double taxation. The complex and intricate conceptual issues relating to the jurisdictional basis of international taxation, tax treaty source rules for several types of incomes and methods for relief from double taxation are analyzed at length. Mr Khan's account of the historical evolution of tax conventions is highly informative and needs careful reading. The contributions made by the League of Nations, OEEC, OECD and the United Nations in evolving a prototype model tax convention to avoid double taxation of cross-border taxation are examined in an analytical framework. The commentary on each article of the conventions is exhaustive. It is based on both the theory and practice of international tax issues. A comprehensive listing of operational bilateral tax between a selected group of countries, as provided in the annex, is a reference for the busy reader.”

Commenting on the nature and importance of the book, Professors Oliver Oldman, Learned Hand Professor of Law Emeritus, Director of Harvard Law School International Tax Program (1964-89), observes: “This comprehensive work provides a 21st century picture of where we are in the untold story of the formulation of international tax rules and issues relating to cross border transnational activity, The context is the vast network of bilateral tax treaties. The book is the outgrowth of the long experience in the civil service of Pakistan coupled with substantial experience abroad. The author spent a year at Harvard University in Cambridge USA while I was Director of the International Tax Program there, served as Director of the Asian Pacific Tax and Investment Research Centre in Singapore for several years in the eighties, participated in the negotiation of tax treaties and conferences in many countries, and has interacted often with the tax experts in private sector. His combination of scholarly activity and practical experience has placed him in a usually good position to reflect upon his experience and to elucidate the continually changing borders of meaning. and interpretation. Particularly useful for example, is his chapter on Permanent Establishment in the light of the evolution of ways of doing business. The author provides a reliable guide to the subject at the beginning of the new century without pretending to prescribe or predict how the picture should or will look in the coming decades.”

Reflecting on international efforts to avoid double taxation, the author observes: “These efforts of the international community are reflected in the work of the League of Nations, EEC, OECD, and, most recently, by the United Nations in the form of model conventions for the avoidance of double taxation of income and capital. The latter two models have generally been accepted as the reference documents for the purposes of negotiating the bilateral tax treaties. The OECD and the UN Commentaries are a significant background material for the implementation of these treaties.”

Discussing several types of tax laws, the author states: “The taxation issues, particularly those concerning the determination of residential status, source of income, permanent establishment and fixed base, allocation of profits and deduction of expenditure, withholding taxes and many more are comprehensively elaborated in the work of the OECD and the UN Ad Hoc Group of Experts on Tax Treaties between Developed and Developing countries. These issues have also been extensively debated at various international and regional levels. It has, nevertheless, been observed that the interaction between the provisions of tax treaties and national taxation laws, particularly in the context of specific circumstances of enterprises engaged in businesses across national borders, results in issues and disputes which are not easy to resolve. Efforts on the part of unscrupulous taxpayers in deriving unintended benefits out of the tax treaties further complicate the matters. The national tax administrations and courts in the process of dispute resolution also come up with rulings which, by their nature being case-specific, make the job of business enterprises and tax practitioners, if not very difficult, somewhat complicated.”

Explaining the information gap that exists in the domain of cross border transactions and taxes, the author states: “While extensive literature on taxation of profits arising from cross border transactions is available in the developed world, the tax administrations, business enterprises and practitioners in the developing countries face major information in handling matters concerning tax treaty implementation. It is to fill this information gap that, some years ago, the author decided to undertake a detailed review of the relevant literature on tax treaties, rulings of the tax administrations courts, OECD, and UN's work, and identify the significant tax treaty issues in an objective and transparent manner. This analysis led to the preparation of notes for several of the seminars, conferences, and workshops on international taxation which I had the opportunity to participate in. In recent years, conducting several such conferences, the need for authoring a comprehensive book on cross border transactions and bilateral tax treaties was immensely felt to address the needs of the interested groups, particularly in the developing countries.”

Cross Border Transactions and Tax Treaties — Theory and Practice by Ahmed Khan is a comprehensive book on contemporary tax issues, protocols, and treaties. It is a great reference for policy makers, academicians, tax authorities and practitioners of tax issues; and a useful resource for students pursuing programs in international tax law, international finance, and tax accounting.

(Dr Ahmed S. Khan - dr.a.s.khan@ieee.org - is Fulbright Specialist Scholar, 2017-2022).