Pakistan Tech Summit 2020 at Draper University in San Francisco Bay Area

By Riaz Haq

Hundreds of Pakistanis and Pakistani-Americans attended the Pakistan Tech Summit 2020 at Draper University in San Mateo, California on February 15, 2020. It was organized by Arzish Azam of Ejad Labs with sponsorships from JS Bank, Netsol, VisionX, Pakistan IT Ministry, Pakistan National IT Board and Pakistan Software Exports Board.

This event came after the recent publication of a report in Germany's Deutsche Welle (DW) by Miriam Partington. In a story titled "Pakistan: The next big Asian market for tech startups?" she wrote that "Pakistan's young and tech-savvy population, market of over 220 million people and increasing levels of local capital are creating opportunities for tech entrepreneurs".

Pakistan Tech Summit

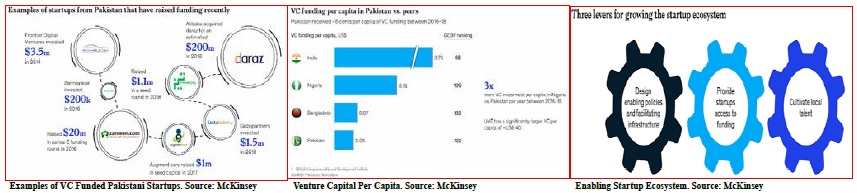

At this conference, I was really encouraged by the presence of many young Pakistan entrepreneurs eager to realize the vision of Digital Pakistan. Enthusiasm is necessary but not sufficient. What is missing is serious attention to attract more risk capital to support these young enthusiastic entrepreneurs. Unfortunately, I did not see any known Silicon Valley venture capitalists (VC) at the event. Recent McKinsey report on Pakistani startup ecosystem noted that per capita venture capital is just 6 cents, lower than 7 cents in Bangladesh and only a third of 18 cents in Nigeria. What Pakistan needs is a venture capital initiative along with digitization initiative.

Founders or cofounders of several Pakistani startups pitched their companies hoping to attract venture investors. Among the attendees were many young enthusiastic techies.

Najeeb Ghauri, Chairman of Netsol Technologies, made a pitch that focused on the opportunities presented to investors by Pakistan's growing young enthusiastic talent pool and large aspirational middle class population. JS Bank's Noman Azhar talked about his bank's fund that invests in Pakistani startups taking advantage of the government's Digital Pakistan Initiative. An example of their investment is e-challan systems in Islamabad and Peshawar.

The morning keynote speaker was Farrukh Mahboob of VisionX which offers custom-built digital products and mobile applications for businesses. Their digital solutions are tailored to clients’ needs and are powered by emerging technologies including artificial intelligence (AI), augmented and virtual reality (AR, VR). VisionX clients includes Fortune 500 companies.

A number of startup pitches followed. Founders or co-founders of DontPort, Integry, Kumlaudi, SafePay, JoyCo and Social Pie pitched their ideas.

Examples of VC Funded Startups

McKinsey report "Starting up: Unlocking entrepreneurship in Pakistan" has cited Daraz, Zameen, PakWheels, Tez Financial, Patari, AugmentCare and Sastaticket. Monis Rahman, CEO of Rozee.pk, says this is an incomplete list. He personally knows about funds raised by the following companies that are missing from the McKinsey list:

Rozee.pk -- $9 Million across 3 rounds

Finja -- $4.5 Million seed + bridge (working on $15 Million round)

Airlift -- $12 Million Series A (working on $20 Million round)

Examples of VC Funded Pakistani Startups. Source: McKinsey

Lack of Venture Capital

It was great to see many young Pakistan entrepreneurs eager to realize the vision of Digital Pakistan. Enthusiasm is necessary but not sufficient. What is missing is an enabling environment for startups to attract more risk capital to support these young enthusiastic entrepreneurs. Unfortunately, I did not see any known Silicon Valley venture capitalists (VC) at the event. Recent McKinsey report on Pakistani startup ecosystem noted that per capita venture capital is just 6 cents, lower than 7 cents in Bangladesh and only a third of 18 cents in Nigeria. India's level of per capita is at $3.72 and UAE's $40 per capita VC investment is more than 10X India's.

Need for Venture Investment Initiative

Pakistan needs to have a venture capital initiative to ensure that Pakistani startups fully participate in Digital Pakistan Initiative. Part of the venture capital initiative should create legal and policy framework to protect investors and facilitate their exit strategies. Pakistan government should invite venture capitalists and offer to participate as a significant investor in professionally VC funds that invest in Pakistani startups. Experienced Pakistani VCs and entrepreneurs like Asad Jamal and Monis Rahman can be used as a resource to establish this venture investment initiative.

Summary: Recent "Pakistan Tech Summit 2020" at Draper University in San Francisco Bay Area attracted dozens of enthusiastic tech savvy young men and women ready with their startup pitches. It confirmed what Deutsche Welle's Miriam Partington recently reported in a story titled "Pakistan: The next big Asian market for tech startups?" in which she wrote: "Pakistan's young and tech-savvy population, market of over 220 million people and increasing levels of local capital are creating opportunities for tech entrepreneurs". Unfortunately, I did not see any known Silicon Valley venture capitalists (VC) at the event. A recent McKinsey report on Pakistani startup ecosystem noted that per capita venture capital is just 6 cents, lower than 7 cents in Bangladesh and only a third of 18 cents in Nigeria. India's level of per capita is at $3.72 and UAE's $40 per capita VC investment is more than 10X India's. Pakistan needs to have a venture capital initiative to ensure that Pakistani startups fully participate in the Digital Pakistan Initiative. Part of the venture capital initiative should create legal and policy framework to protect investors and facilitate their exit strategies. Pakistan government should invite venture capitalists and offer to participate as a significant investor in professionally managed VC funds that invest in Pakistani startups. Experienced Pakistani VCs and entrepreneurs like Asad Jamal and Monis Rahman can be used as a resource to establish this venture investment initiative.

(Riaz Haq is a Silicon Valley-based Pakistani-American analyst and writer. He blogs at www.riazhaq.com)