No Stimulus Check Yet? Here Are 7 Possible Reasons for Your Wait

By Sigrid Forberg

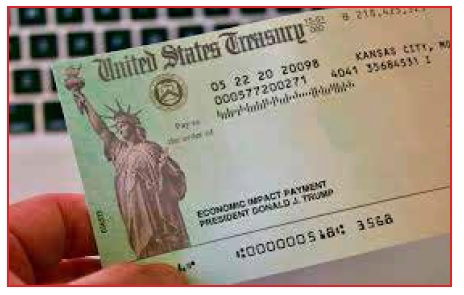

It took the IRS just two days last week to start processing $1,400 stimulus checks after President Joe Biden signed his $1.9 trillion relief package into law. The third direct payments of the pandemic began to show up in bank accounts over the weekend.

That means many Americans already have more money to take care of bills, pay down debt, save or invest.

But if you keep refreshing your online banking and still aren't seeing the cash, what's happened? Here are seven good reasons you haven't received your money yet.

1. The IRS is sending out the stimulus checks in 'batches'

The IRS has a juggling act as it distributes these stimulus checks at the height of tax season. IRS Commissioner Chuck Rettig promised in a news release that the multitasking wouldn't slow the delivery of relief payments he said were needed by millions of Americans "to cope with this historic pandemic."

But even with IRS employees working around the clock, getting the stimulus checks out is a huge task for the tax agency. So, it's splitting the aid payments into batches.

The first batch of direct deposits started arriving last weekend. Another batch was to go out this week, with more to follow in the coming weeks, the IRS says.

2. Your bank hasn’t processed your stimulus check yet

You may have received the money but just don’t know it. That’s because two major banks aren't giving their customers access to their $1,400 before March 17.

While some smaller banks decided to go ahead and make the funds available to consumers immediately, JPMorgan Chase and Wells Fargo said they wouldn't put the money into accounts until the Treasury’s "effective date" for the payments. Some customers have threatened to close their accounts in protest.

Already there's speculation over whether there will be a fourth stimulus check, but don't count on it. So use your $1,400 wisely — maybe by putting it to work using one of today's popular investing apps.

3. You moved or changed your bank account

If you recently switched bank accounts, the IRS probably doesn’t have your new account information on file — meaning it's not able to send you a direct deposit. You'll have to wait for the tax agency to mail you a paper check or debit card, and that will take weeks.

A similar issue applies if you moved recently and normally receive tax refunds through the mail. If the IRS unsuccessfully tries to send your payment to your old address, the check will need to be reissued and you'll face an extra-long wait.

You can check on the status of your stimulus check by using the IRS' Get My Payment tool. And though you can’t update your information there, you can potentially identify why your payment has been delayed.

4. The money has been siphoned off by a debt collector

You may not see your stimulus check yet because the money has been intercepted. Debt collectors couldn’t garnish the two earlier relief payments, but a legislative loophole has given them access to this round.

Because the bill was fast-tracked through Congress using an arcane budget process, the cash can be seized to pay many types of debt, though not tax debt or back child support.

If your stimulus payment is at risk because you're overwhelmed by debt, a lower-interest debt consolidation loan can help you get a handle on what you owe — and pay it off more quickly.

5. You’re getting a paper check or debit card

The IRS is prioritizing direct deposit payments, so if you'll be receiving a paper stimulus check or a debit card, you may be waiting a while for your $1,400.

It can take up to a few weeks for the paper and plastic to reach their intended recipients.

When last year's first $1,200 stimulus checks went out, some people mistook their mailed checks or debit cards for junk mail. So if you know you'll be receiving your money via the Postal Service, be alert when you check your mailbox over the next few weeks.

6. You haven’t filed taxes the last two years

Not every American has to file federal income taxes every year. For example, if you earn less than $12,400 a year, don't have self-employment income, are single and under age 65, you don't have to file a tax return for 2020.

But if you’re not receiving Social Security or Railroad Retirement Benefits and haven’t filed taxes for 2019 or 2020, then the IRS will have no record of your eligibility for a stimulus check.

To ensure you’ll get your payment, fire up a reliable tax software program and get yourself on the tax agency's books.

7. You don’t qualify for a stimulus check anymore

After much back and forth, the Democrats who control Congress agreed to a more targeted approach for this round of stimulus checks.

Individuals making more than $80,000 and couples earning over $160,000 get no money this time.

Previously, the cutoff thresholds were $100,000 for single taxpayers and $200,000 for couples filing jointly.

What if your money is missing — and you need it now?

If it appears your stimulus check will be delayed, or if the new income guidelines mean there's no cash for you, there are several options if you need money like yesterday.

• Slash your insurance bills. Car insurance companies have been handing out discounts to drivers who are on the road less through the pandemic. Not yours? Sounds like it’s time to shop around for a better deal from a more flexible provider. And while you’re looking, why not save hundreds on homeowners insurance by comparing rates to find a lower price?

• Reduce your mortgage payments by refinancing. Mortgage rates remain historically low, and refinancing your existing mortgage could reap big savings. The mortgage technology and data provider Black Knight reported in early March that 12.9 million mortgage holders were good refinance candidates, meaning they could cut their monthly payments by hundreds of dollars with a new loan.

• Trim your budget and “make your own” stimulus check. By finding a few creative ways to cut back, you can possibly rearrange your budget to find another $1,400. Use cloth instead of paper napkins, refill water bottles instead of buying bottled water, and use your own coffee cup to get a discount at your local cafe. Have a hobby or special talent? Turn it into a side income. And, download a free browser extension that will automatically hunt for better prices and coupons when you shop online. - MoneyWise

-----------------------------------------------------------------------------

Back to Pakistanlink Homepage